Overcoming Misconceptions About Healthcare Benefits: Part 3

Cost Reduction vs. Cost Shifting

I’m not quite sure that passengers were literally rearranging the deck chairs on the Titanic as it sank in 1912, but the saying is often used to describe a futile action in the face of impending catastrophe. In other words, it means to do something that contributes nothing to the solution of a current problem.

If you and I break away from the office each and every day to eat lunch, and we go to the same place every day, eat the same meal, and split the same check 50/50, but then one day, I say to you, “I’m a little short on cash today, can you pick up 70% and I’ll pay 30%”, have we lowered the cost of the meal? No, we haven’t, the cost has simply been rearranged, or SHIFTED. What I used to pay half for on other days, I only paid 30% for today, but the price of the meal stayed the same. Would you think it a good deal if I said that this was now a “cost reduction” strategy that I was implementing for OUR lunch costs? How good of a deal is that for you my friend?

Employers who attempt to offset increases in cost by slowly and incrementally raising premiums, or co-pays, OR DEDUCTIBLES, or maximum out of pocket amounts on employees…..all of these are tactics likened to rearranging the deck chairs on the Titanic! They are futile attempts at lowering costs! None of these measures actually reduce the unit cost of care, not one of them. Instead, they SHIFT costs on to employees, the most financially vulnerable players in this equation. If health plan costs go up 13% and the City raises the employee’s deductible, did that somehow lower prescription drug prices? Did it lower the price of an MRI? Did it lower the price of hospital stay? No. It simply transferred more cost on to the employee. This tactic has a shelf life, I promise you. It’s an unsustainable approach to healthcare benefits and reform. Here’s why:

Since 2008, employee deductibles have risen 8x faster than wages, and this massive SHIFT in who is paying for healthcare has eroded ALL middle class wage gains over the past 50 years. Want to know what’s stealing your employee’s futures, their children’s futures? Healthcare. This is why I passionately dig into City budgets. This is why I passionately shine a light on status quo thinking. This is where the status quo has led us, right here to this chart, and it’s time for us to think differently, approach this issue differently. Research also shows that as employee deductibles rise, employees do not magically morph into these super-savvy consumers who are aggressively shopping for the best deal on healthcare. In fact, research shows that when deductibles rise, people simply begin to DELAY OR FOREGO care altogether. This leads to more complex, serious, and costly care down the road for many people. Not good for anyone, and this problem is getting worse. COST is consistently cited as the #1 barrier to quality healthcare by employees, yet incrementally raising deductibles and out of pocket responsibility is pushing more cost on to employees.

From the City of Amarillo’s 2019/2020 Budget: Since 2013 the City has made significant changes to control costs, deductible increases, out of pocket increases, dependent eligibility audits and premium increases. All of these things simply SHIFT costs on to employees. They do not reduce nor “control” costs. Also from the budget language: In keeping with our general philosophy of an incremental approach to rate increases, for 2019, we plan to increase the employer contribution by 7%, and the employee premiums by 2%. Incremental rate increases? Pay attention to the language here, they are EXPECTING their costs to rise each and every year. This is a mindset, it’s a paradigm. The City has done it this way for so long, they now do it without ever stopping to ask the questions, “why does it have to be done this way?”, or “is there a better way to do this?”

It is important to note, the City of Amarillo increased employee pay by 2% this year, costing the City an additional $3.2 Million. But the health plan costs increased by 13%, adding an additional $4 Million to the budget. Wage gains are gobbled up by healthcare cost increases, and it’s unsustainable. Between wages and benefits, an increase of more than $7M in a single year is certainly cause to look into different strategies. I wonder what other tax payers think about those figures?

The underlying problem that these “tactics” do not address is the UNIT PRICE OF CARE. The actual price you pay. This is the root issue employers need to get at, THE PRICE of care. But employers have very little say in the price they pay for healthcare. Instead, they have entrusted large insurers to negotiate pricing for them via secret and proprietary “network contracts” based on large discounts off even larger billed charges. We’ve already covered, in Part 2 of this series, that insurance companies aren’t negotiating best pricing, but we keep on believing that they are. This is yet another “mindset” that has to change.

In 2003 Health Affairs published a study on what America spends on healthcare compared to other first-world countries. One of the key findings was that the biggest reason America spends more on healthcare than all other countries is simply because of the PRICE we pay for healthcare vs other countries. Not because we’re sooooo much sicker, and not because we utilize healthcare services sooooo much more than other countries…..just that our prices are way higher. Let’s take a look locally.

Here is a comparison of hospitals in Amarillo and Lubbock on a Myocardial Infarction (heart attack). The green bar represents AVERAGE BILLED CHARGES. The orange bar represents AVERAGE COST (self-reported figures to CMS), and the blue bar represents the AVERAGE MEDICARE REIMBURSEMENT AMOUNT. Lastly, the yellow line represents overall QUALITY SCORE for the particular facility and procedure.

Northwest TX Healthcare System charges more than $80,000 for this procedure, while their self-reported costs to Medicare are closer to $13,000. The thing to notice here is the price variance you see from facility to facility. Lubbock Heart Hospital charges $37,000 on average for this procedure, while Covenant Hospital is charging in excess of $125,000 for the same procedure in the same City. When health insurance reimbursement contracts are negotiated based on BILLED CHARGED amounts (price), and a discount of or off of billed charges, it’s a pretty big difference for the true payors (employers and their employees). Keep in mind, most insurance carriers have ALL of these facilities in their “networks”. That begs the question, what VALUE do PPO networks bring anymore? What is “Preferred” about a Preferred Provider Organization anymore? On one end of the spectrum, the PPO network includes very high-quality/low-cost providers and facilities, yet it also includes very low-quality/high-cost providers and facilities….and guess what….your employees have no idea which is which!

The other interesting thing to take from this graph is the Medicare reimbursement level. They are all much more in line with one another from facility to facility. Why is that? Primarily because CMS reimbursement levels are based on a facility’s COSTS, which CMS requires them to report annually, and not their arbitrary chargemaster list PRICE.

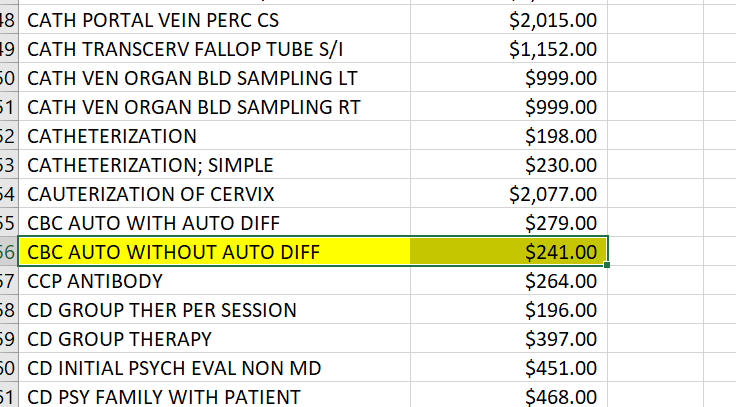

Here’s yet another example. The image below is from a hospital’s CHARGEMASTER, which facilities are now required to share online. This shows the list price for many services, but I want to focus in on the “CBC AUTO WITHOUT AUTO DIFF” charge of $241.00. This is a Complete Blood Count without Automated Differential, a simple lab test. CPT Code 85027.

This hospital is charging $241 for this lab test that we commonly arrange for clients through primary care physicians for $6. I know most health plans aren’t paying $241 for this lab test, but if they are getting say a 60% off billed charge “discount”, employers and their employees are still paying $96 for a test we get for $6. And because more and more employers are migrating towards HIGH DEDUCTIBLE HEALTH PLANS, or, “Consumer driven plans”, employees are often the ones left paying these prices. Cost shifting is hurting employees, and it’s robbing them of meager pay increases. Cost shifting is not a cost reduction strategy, it’s simply rearranging the deck chairs on the Titanic.

To wrap Part 3 up, I want to address this statement from the City of Amarillo 2019/2020 budget: Overall, the City is very pleased in the cost saving measures experienced by the Health Plan during the last four years. However, as we come up to our last extension on the Aetna contract for calendar year 2020, we are aware of the realities of health care costs in the current market. We will work with our healthcare consultant to ensure that the next contract is negotiated fairly and with cost control and savings in mind.

There is so much to unpack, just from this statement. It troubles me that our City leaders are “very pleased” with 10% cost increases year over year and with incrementally shifting costs on to employees. Our City claims to be aware of the “realities of health care costs in the current market”, but hopefully after reading this series, they will come to realize that healthcare COSTS are in fact, not inflating at high rates. Lastly, they claim that THIS TIME, they will work with their healthcare consultant to ensure that the NEXT CONTRACT is “negotiated fairly and with cost control and savings in mind”. Does this mean the last contract wasn’t negotiated fairly and with cost control and savings in mind? And if the City is “very pleased” with past results, why have your current consultants renegotiate terms at all? Who are they negotiating with? Will terms actually be negotiated based on COSTS, or Chargemaster PRICES again? And if they’re negotiating for deeper network discounts, well…..you know how the saying goes, “fool me once……” Here at the very end of Part 2, I have a couple of ideas for the City of Amarillo: Instead of periodically issuing an RFP for fixed cost services, TPA’s/PBM’s, etc….why not put your CLAIMS out to RFP, and let healthcare consultants bid on strategies that actually lower CLAIMS costs?? Secondly, why not tie your consultant’s compensation to those results??? Pay for results, not activity! If your costs are increasing by double digits year over year, and the consultant’s job is to show you how to REDUCE costs….well, it is safe to say our City isn’t getting what we’re paying for.

PERCEPTION: THAT SLOWLY AND INCREMENTALLY RAISING PREMIUMS, CO-PAYS, DEDUCTIBLES, AND OUT OF POCKET AMOUNTS FOR EMPLOYEES IS REDUCING HEALTHCARE COSTS.

Once again……5 Pinocchios. Cost shifting isn’t a cost reduction strategy and it is hurting the most vulnerable people in the equation, employees.

Part 4 will be the final Part in this series. On the day I was finishing up this Part 3, former Mayor Jerry Hodge, and CEO Alex Fairly filed a lawsuit against Amarillo Independent School District claiming the District did not give proper due diligence to a proposal that allegedly reduces the District’s healthcare costs by $10-$15 Million over a three year period while delivering equal or better quality benefits for District employees and teachers. We’ll address that, along with some final points about the City of Amarillo, and why this AISD lawsuit should make all employers sit up and take notice of the innovative changes taking place in healthcare finance and risk management today. It is being argued, that when self-funded health plans, like the City’s, grossly overpay for healthcare goods and services, that they have violated their fiduciary responsibility not to waste plan assets. That’s all in my final Part 4. Hope you’ll give it a glance…..

One response to “Overcoming Misconceptions About Healthcare Benefits: Part 3”

Leave a Reply

You must be logged in to post a comment.

Part 4 will be finale of this series. Thanks for reading!