Overcoming Misconceptions About Health Benefits: Part 2

Let’s continue on in this analysis, shall we? In Part 1, we discussed the very common misconceptions that “networks”, namely PPO networks, reduce healthcare costs, and that 10% annual cost increases are “normal”. Neither of which are true. Let’s pick up where we left off.

Similar to the misconception that networks reduce healthcare costs, another common misconception is that because insurance companies have thousands and thousands of members, they use large numbers of members as leverage to get the best and lowest prices for healthcare services. This is simply not true, and I’ll use a very common and easy to understand example as an illustration.

A few months ago, well before the pandemic hit, I stood in line at the pharmacy to pick up my medication, a generic blood pressure med. I happened to overhear the pharmacy tech answering questions for the customer in front of me, who had mentioned the name of their medication they were picking up. Because of my work, I knew information about the particular prescription the customer was picking up, and I knew it was a very affordable generic drug. However, the customer proceeded to pull out their insurance card, remind the tech they had insurance, and the tech replied, “Great, I see you have a $15 co-pay today.” The customer grinned and paid the $15 co-pay, collected their prescription, and went about their way.

That customer paid a $15 co-pay for a medication the pharmacy charges $2 cash for. Who negotiated and/or designed the $15 co-pay to begin with? The insurance carrier, that’s who. And it wasn’t until very recently that pharmacists were allowed to educate patients at the point of sale of this type of situation. Prior to the Trump administration lifting the gag order on pharmacists, they couldn’t disclose this fact to their patients. But carriers are still to this day designing plans with $15 generic co-pays knowing full well that hundreds upon hundreds of medications fall under this price point without insurance.

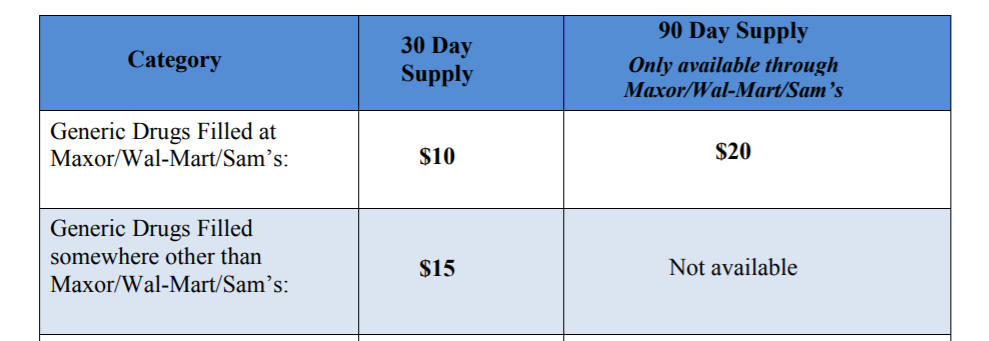

Even under the City of Amarillo’s plan, you see the plan design as such:

Wal-Mart alone literally sells most of the drugs that fall under these “Generic” categories for less than $5 WITHOUT INSURANCE! Tell me again how the insurance companies are negotiating lower prices for consumers. This is ONE example of how it just aint so folks. So why do people use their insurance in these scenarios? Because we’ve all been conditioned to believe that ALL healthcare (even cheap generic meds) are so expensive, we have to have insurance to “cover” the costs for us. Bull! This is nothing more than a mindset shift, overcoming a misconception! And the City needs to take notice…..your employees can buy these meds, or your self-funded plan can buy these meds, for less than what the City is paying through the current PBM contract, and I haven’t even begun to broach the subject of spread pricing on generic meds, formulary rebates that you aren’t getting, and other ways PBM’s make money off your plan.

But allow me to illustrate the City’s mindset in this area. From the 2019/2020 budget language, in relation to the CityCare clinic (which I address later): A side benefit of our Clinic is that the Clinic is the largest writer of prescription drugs in our plan and predominately prescribes the lower-cost generic and formulary drugs, which helps contain costs. Well that sounds wonderful! Except for the fact our own City clinic is writing prescriptions where employees, in most cases, are paying co-pays that are higher than the cash prices the pharmacies charge with no insurance coverage whatsoever. Secondly, how does the City know that ANY generic prescribed through their City clinic would have been prescribed as a name brand outside their clinic? They don’t, and they certainly can’t put a figure on it.

But what if the City paid for generic medications in a different way? With no formulary manipulation games, no rebate games, no spread pricing games, no MAC lists or AWP minus whatever percentage? What if the City purchased generic medications with a KNOWN, FIXED price and then offered them all to employees WITH A $0 COPAY?!? And what if they could do all that and still reduce plan costs by tens upon tens of thousands of dollars per year? They could, but they’ve bought in to the misconception that big insurance carriers and PBMs have negotiated the lowest possible price for healthcare goods and services, including prescription drugs. What’s needed? A mindset shift for starters…..

PERCEPTION: BECAUSE BIG INSURANCE COMPANIES HAVE THOUSANDS OF MEMBERS, THEY USE THAT AS “LEVERAGE” TO NEGOTIATE THE LOWEST PRICE FOR HEALTHCARE GOODS/SERVICES.

I also give this perception 5 Pinocchios cause it just aint so……PART 3….in the works……

Leave a Reply

You must be logged in to post a comment.