Health Insurance Math: $25 Copay for a $.37 Drug

Amlodipine is one of the most common generic medications in America. It is most commonly used to treat high blood pressure, coronary artery disease, and angina, a type of chest pain. Amlodipine relaxes your blood vessels so that blood can move through them more easily so that the heart doesn’t have to work so hard.

In 2022, approximately 70 million Americans were taking Amlodipine, down from it’s high in 2018 of 76 million Americans.

But I’m not here to tell you about how a prescription drug works, I’m not a doctor. I want to talk about the way most people purchase Amlodipine – via insurance plans that have “copays”.

For years, I’ve spoken about the ridiculous copay levels we see on some health plans for generic drugs. Like this Blue Cross/Blue Shield plan that is offered through the federal marketplace here in our area:

$25 copay for generics, like Amlodipine.

What most people don’t know is that the acquisition cost of Amlodipine, 2.5mg, is about $0.012 per pill, or 37 CENTS for a 30-day supply. That’s correct, 37 cents per month, or about $4.40 per year.

But if a person is purchasing Amlodipine through a health plan like this, they are paying $25 per month, $300 per year for their medication. That is a 6727% markup on the prescription. And up until 2018, it was illegal for a pharmacist to tell a patient with a $25 copay (or any amount) that their medication could be purchased for less than $5 cash.

Here is what many people think – “I paid my copay amount to the pharmacy, so the pharmacy kept that money, they are the ones ripping me off.”

Not so fast. Reimbursement agreements between pharmacies and Pharmacy Benefit Managers (PBMs) often dictate how much of the copay the pharmacy retains, if any. PBMs often set the copay amount and manage the payment process between pharmacies and insurers.

In many cases, PBMs can “claw back” part or all of the copay from the pharmacy. This means the pharmacy may only retain a portion of the copay, but in many instances, none at all. Then PBMs keep the difference between the copay collected and the actual negotiated cost of the drug. Doesn’t seem fair does it? Insurance company designs a health plan with a $25 generic copay > PBM has ability to “claw back” that $25 copay from a pharmacy > Insurance company also owns the PBM and their own pharmacies……

Health insurance companies don’t just collaborate with PBMs, they own them. The three largest PBMs in the country control about 80% of all prescriptions in the country. They serve around 270 million Americans.

CVS Caremark is a subsidiary of the CVS drug store chain and part of CVS Health, and in 2018 acquired Aetna in a $69 Billion acquisition. CVS Caremark is one of the three largest PBMs in America, and also owns pharmacies.

Then there is Express Scripts (ESI), owned by Cigna’s Evernorth Health Services. As the third largest PBM in America, ESI accounts for approximately 24% of the PBM industry’s managed claims.

And then there’s Optum. Optum is a subsidiary of United Health Group, the largest health services provider in the country, and also the largest employer of physicians as well. In 2023, Optum reported revenues of approximately $227 Billion.

These PBMs are powerful, and a recent investigation by the Federal Trade Commission into PBMs revealed PBM favoritism toward their own pharmacies and vast market control, which affects both medication access and affordability. Of course they favor the pharmacies they own! In addition, PBMs also contributed to a 10% closure rate of independent pharmacies in rural locations between 2013 and 2022. It’s because they have the power to squeeze independents, and grow their monopoly power.

They have the power to “claw back” these $25 copays for a 37 cent drug, and line their pockets with the difference, all at the expense of me and you – patients and covered members on health plans. This also crushes smaller, independent pharmacies, eliminating the PBMs competitors.

So, why would anyone pay a $25 copay for a prescription that costs less than $1 per month? Because they simply don’t know the true “cost” of what they’re buying, and they don’t know how to find it for less. Amlodipine costs $0.012 per pill to purchase, and the average generic copay in America is $7 now. That’s on one generic med – there are more than 32,000 generic meds. So, “insurance” didn’t “cover” anything….you paid a $25 copay for a 37 cent drug……no, you also paid PREMIUM to the insurer for the luxury of paying a $25 copay for a 37 cent drug, and the PBMs and their pharmacies are keeping it all. Why are we doing this to ourselves? And make no mistake, employers are selecting plans that do this to people, and it’s time to stop the madness.

Employers: Time For Change

We launched High Plains Health Plan in 2022 with a different philosophy. We wanted to create a health plan that lowered the unit cost of care so substantially, we could offer benefits like $0 deductibles and $0 copays to covered members. We’re delivering.

Under our plans, all generic medication is covered with a $0 member copay, and by now, you should clearly know “how” we do it, and why we do it. Under HPHP, we purchase Amlodipine for $3.37 per month, which is our true acquisition cost of Amlodipine (37 cents for 30-day supply), plus a simple, non-revocable $3 dispensing fee to the pharmacy for receiving the prescription, measuring it out, bottling it for the patient, and doing this routinely every 30 or 90 days. These pharmacies do all of the same work for the big insurers who own the big PBMs too…..but those big PBMs “claw back” almost every single dollar in copays the patient pays. That’s right….many independent pharmacies are essentially working for Optum, CVS Caremark, and ESI for nothing.

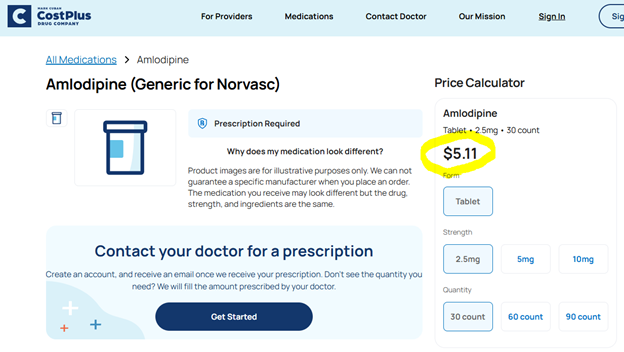

Even Mark Cuban doesn’t sell Amlodipine for $3.37 per month. Look here:

$5.11 is a decent price, and Cuban is also sounding the alarm about the big PBMs and how they rob the American public, just go read his X account. He frequently talks about how the big PBMs are “shitting” on independent pharmacies and fleecing the public.

What’s the fix? Stop doing business with the big PBMs and work with people/organizations that can help you….it’s that simple.

Which brings me back to High Plains Health Plan: why is HPHP in business? Well, that’s simple too.

This Amlodipine example I just laid out is one example of a million on why the American people hate and distrust the healthcare and health insurance industries. As Mark Cuban says, “Nobody trusts anything beyond their own doctor.” And why would they? Insurance companies who construct health plans with $25 generic copays aren’t looking out for people. They’re laughing all the way to the bank, with your money firmly in hand.

At HPHP, we use transparency to earn your trust. We show employers examples like this one, and many others, and then we show them the way out. Our plans are pretty simple: We reduce the unit cost of CARE (drugs, surgeries, hospital stays, MRIs, doctor visits, etc), and then we share a portion of the savings back to plan members through $0 deductibles and copays.

For years, employers have told us what they are looking for: lower costs, better benefits. But many have stopped believing that’s possible to attain. So, let me SHOW YOU how possible it is.

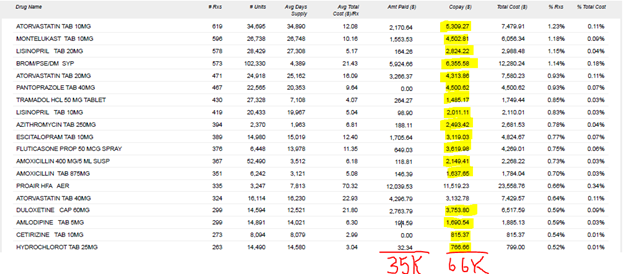

Below is the top 19 generic drugs by volume for the City of Amarillo. Amlodipine is there! The copay column is how much employees spent out of their own pockets on “copays” to fill these 19 medications. The “Amt Paid ($)” column is the amount the City’s health plan paid in addition to the member copay amounts.

As you can see, employees paid almost DOUBLE the amount the health plan paid towards these medications. And this is only on 19 drugs in the plan. Employee copays were $66,000, and the total plan spend on these same meds was $35,000, for a total of $101k.

So, if the City were to eliminate the copays for just these 19 drugs, it would cost the health plan an additional $66,000. But that’s assuming THE SAME PRICE is paid for the drugs, not a lower price.

Now, let’s go back to the Amlodipine example, and remember the price we pay on HPHP? $3.37 for a 30-day supply. The City’s total cost (plan cost and member copay) is right there in the screenshot. It’s 53.5% higher. The City’s plan is paying $6.30 per 30-day fill on average. What if each of these generic meds could be purchased for 53% less? What if some were puchased for 65% less, like Atorvastatin, where the City is paying an average price of $12.08 for a 30-day supply that we purchase through HPHP for $4.20 for the same 30-day supply? Or 74% less, like on Fluticasone nasal spray, where the City is paying an average price of $11.35 for a 30-day supply that we purchase for $3?

The total spend on these 19 drugs was $101,000 ($35k plan paid, and $66k in member copays paid). If the City was purchasing these 19 meds for 53% less across the board, it would save $54,000 per year…..That almost covers the entire cost of the copays. This is not factoring in any amounts saved on Brand name drugs, and Specialty drugs. I’ve shared other examples in previous articles about our strategies on Specialty drugs and how much they save employers. The combined savings far surpasses the amounts being paid in generic copays by employees.

In fact, City of Amarillo employees, on ALL generic medications, pay approximately $365,000 a year in copays, yet, we have shown the City of Amarillo more than $2 Million of RX savings opportunities on a very small handful of Specialty meds in the plan. The impact is meaningful. Eliminating copays on 86% of all the prescriptions filled in a plan year (generics), hundreds of thousands of dollars put back into the pockets of City employees, and still providing net savings to our tax payers who fund this health plan. By all accounts, that’s “winning”. So why aren’t more employers, like the City of Amarillo, adopting these strategies?

Our solution is simple: Pay less for drugs….share savings with employees. Simple, smart, and effective.

Universal Application Across the Plan

The exact same principle can be universally applied across all episodes of care and items purchased through the health plan; hospital stays, diagnostic imaging services like MRIs, CT scans, Xrays, outpatient surgical procedures, primary care visits, lab work, you name it. The principle is simple: pay less for CARE….share savings with employees through $0 deductibles and copays. It’s not rocket science.

So, for those out there saying things like, “There’s no way you can save money and offer benefits like $0 deductibles and copays”, I’m not just telling you it’s true, I’m showing you. Anyone, including your current broker, who is telling you that you can’t pay less for healthcare and benefits, either doesn’t know how to do so, or they’re financially motivated to keep you in insurance products that are in their best interest financially. They don’t want you to fire them, so they convince you that you can’t do any better with someone else, or under a new model. Or they convince you that it’s “too disruptive” to your company to make any change. I don’t blame them….actually, you know what….yes I do, I’m not going to lie. There are brokers out there telling companies that what we do doesn’t work, or they’re telling them they can accomplish the same thing for them….while keeping them in health plans that literally do not even attempt to address the unit cost of CARE.

It’s time you were given a different perspective. I don’t ask anyone to trust me on this. Let us show you. Let us show you how the big PBMs are robbing from your company. Let us show you how to lower the unit cost of care, and seed a portion of the savings back into the quality and value of the benefits you offer employees. Let us prove your broker wrong, who tells you every year, “we’ve looked at everything, and there’s no better deal to be had”. Yes there is, and it’s easier to do than you think.

Leave a Reply

You must be logged in to post a comment.